When it comes to leasing a car, one of the most important terms you’ll encounter is the residual value. This figure plays a vital role in determining your monthly lease payments, as well as the overall cost of leasing a vehicle. Understanding what residual value means can empower you to make more informed decisions about your lease agreement. The residual value is essentially the estimated worth of the car at the end of the lease term, and it significantly influences how much you will pay during the lease period. With a clearer understanding of this concept, you can better navigate the leasing process and ensure you’re getting the best deal possible.

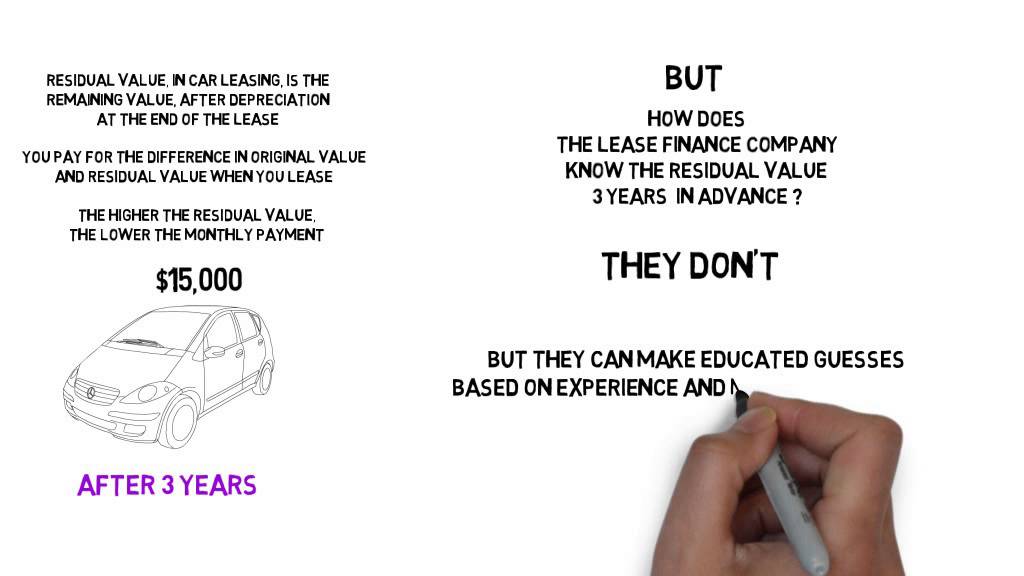

In the context of car leasing, the residual value is a key component that affects not only your monthly payments but also your options when the lease ends. A higher residual value can lead to lower monthly payments, making it an attractive option for many lessees. However, knowing how the residual value is calculated and its implications can be a complex endeavor, filled with various factors to consider.

As you dive deeper into the world of car leasing, you'll realize that understanding the residual value is crucial for budgeting and long-term financial planning. This article will clarify what residual value is, how it is determined, and why it matters in the car leasing process. By the end, you'll be equipped with the knowledge to effectively evaluate your leasing options and make a choice that aligns with your financial goals.

What is Residual Value of Car Lease?

The residual value of a car lease refers to the estimated value of the vehicle at the end of the lease term. It is essentially what the leasing company believes the car will be worth after depreciation. This figure is crucial because it directly affects your monthly lease payments. The higher the residual value, the lower your payment will typically be, as you are financing a smaller portion of the car's depreciated value.

How is Residual Value Determined?

Several factors contribute to the determination of a car's residual value:

- Make and Model: Some brands and models retain value better than others.

- Market Demand: Vehicles in high demand usually have higher residual values.

- Lease Term: The length of the lease can impact how much the car depreciates.

- Mileage Allowance: Higher mileage limits can lower the residual value.

Why is Residual Value Important in a Car Lease?

Understanding the residual value of your car lease is essential for several reasons:

- It helps you estimate your monthly lease payments.

- A higher residual value can result in lower depreciation costs.

- It influences your options at the end of the lease, including buyout possibilities.

What Happens at the End of the Lease?

At the conclusion of your lease term, you typically have a few options:

- Return the car to the leasing company.

- Purchase the vehicle for the residual value.

- Lease a new car.

Deciding what to do will depend on how well the residual value aligns with the current market value of the car. If the market value is higher than the residual value, buying the car may be a good option.

How Do I Negotiate Residual Value?

Negotiating the residual value can be tricky, but here are some tips:

- Research the vehicle's historical value and depreciation.

- Compare leasing offers from different dealerships.

- Ask about potential discounts or incentives that may affect the residual value.

What Factors Affect Residual Value?

Several key factors can affect the residual value of a leased vehicle:

- Vehicle Condition: Well-maintained cars tend to have higher residual values.

- Market Trends: Economic changes can impact vehicle demand and residual values.

- Technological Advances: New technology in cars can affect desirability and value.

Can Residual Value Change Over Time?

Yes, the residual value can change based on market conditions, vehicle condition, and mileage. It’s essential to monitor these factors throughout the lease term, as they can impact your decisions at the end of the lease.

How to Use Residual Value to Your Advantage?

To make the most of the residual value, consider the following:

- Select a vehicle with a high projected residual value.

- Keep the car in excellent condition and stay within the mileage limits.

- Negotiate the lease terms to ensure a favorable deal.

Final Thoughts on Residual Value of Car Lease

Understanding the residual value of a car lease is essential for anyone considering leasing a vehicle. By grasping this concept, you can make informed decisions that align with your financial situation and lifestyle needs. Whether you’re looking to lease for the first time or are a seasoned lessee, knowing how residual value impacts your lease can lead to smarter choices and potential savings.

You Might Also Like

Exploring The Enchantment Of The Willy Wonka Cane SceneMastering The Art Of Riding Like A Ninja

Discovering The Allure Of Shiny Ocean Water

Unveiling The *Man With 1000 Kids* Cast: A Journey Through Parenthood

Unraveling The Mystery Of Unique Raising Kanan Dead

Article Recommendations

- Ashley Park Disney Channel

- Mary J Blige And Diddy

- Laura Cover

- Spider Man Video Sophie

- Gabriela Sabatini

- Jack Dorsey Wife

- Vegas 2160p

- Angelina Jolie Sad News

- Thomas Gordon Dixon

- Justin Vernon Wife